Rising inflation is putting pressure on household expenses across the UK. Your mortgage is likely to be one of your largest monthly payments and reducing the cost could improve your budget.

According to the Bank of England, the inflation rate in November 2021 was 4.2%. That means the cost of living is rising at its highest pace for a decade. From grocery shopping to energy bills, you may have noticed that your regular expenses are creeping up. If you’re looking for ways to cut back, reviewing your current mortgage could help.

While you may think of your mortgage as a static repayment that will remain the same until the end of the term, there may be things you can do to reduce the bill, especially if your mortgage deal has come to an end.

Here are two options that could be right for you.

1. Secure a lower interest rate on your mortgage

How much interest are you paying on your mortgage? As a large expense, even a small change in the interest rate could save you thousands of pounds over the full term of the mortgage.

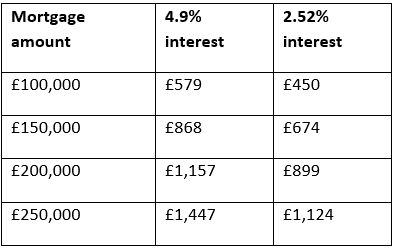

When your mortgage deal ends, you’re often moved to the lender’s standard variable rate (SVR), which isn’t usually competitive. For example, according to Which?, the average SVR was 4.9% in January 2019. This compared to the average two-year fixed-deal cost of 2.52%.

The table below highlights how this would have an impact on your monthly mortgage repayments over a 25-year repayment mortgage term.

Source: Money Saving Expert

Previous research published by Which? found that more than a quarter of homeowners are on their lender’s SVR. On average, these homeowners were paying £4,080 more than they needed to every year. It’s a sizeable sum that could be useful if you’re trying to reduce expenses.

Usually, if you are on an SVR mortgage, you’ll be better off looking for a new mortgage deal. However, there are benefits to an SVR mortgage. They will often be more flexible and allow you to overpay without facing additional charges. If this flexibility is important to you, it may make sense to pay the higher SVR rate. If you’re not sure which option is right for you, please contact us.

1. Extend the term of your mortgage

Another option worth considering is extending how long you’ll pay your mortgage. The longer the term of the mortgage, the lower your monthly repayments will be. If your mortgage deal has come to an end, you may be able to do this when searching for a new deal.

Let’s say you borrow £200,000 through a repayment mortgage with an interest rate of 2.5%. With a 25-year mortgage term, your monthly repayments would be £897. If you extended the term to 35 years, this would fall to £715.

Traditionally, first-time buyers would take out a mortgage for 25 years. As house prices have increased, the market has become more flexible and there are now mortgages that you can pay over 40 years. Choosing to extend the term can make your monthly repayments more manageable.

However, there are two things to be aware of with this option.

- You will usually have to pay off the mortgage before you reach retirement age.

- It will mean you pay more interest over the full term of the mortgage.

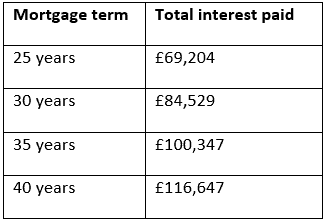

The below table demonstrates how the total amount of interest paid changes depending on the term for a £200,000 repayment mortgage with an interest rate of 2.5%.

Source: Money Saving Expert

While the interest rate you pay is unlikely to stay the same over your full mortgage term, the above shows how interest can add up over a longer period. Once your mortgage deal ends, you could reduce the term of the mortgage when you’re more financially secure and pay less interest over the long term.

What if my mortgage deal has not ended?

If you want to reduce repayments but your mortgage deal hasn’t ended, you may still be able to switch.

If your current deal ends within six months, you can start looking for new deals. You can apply for a new mortgage now, and assuming your application is accepted, you can arrange for it to begin as soon as your current deal ends. As a result, you can avoid paying an SVR.

When the end of your mortgage is further away, you will usually have to pay a fee to end the deal early. You should check your paperwork to find out how much this is and how it’s calculated. While paying a fee now can seem counterproductive, in some cases, it could save you money in the medium and long term.

Whether you’re looking for a new mortgage or have questions about your existing deal, we’re here to help you. Please contact us to discuss your needs and concerns.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

)